[Part II] Finding the Right Quantum Crypto Play is Harder Than You Think

Why it took us 6 months to find & invest in Quip Network - Continued

This is Part II of our quantum x crypto thesis, covering our investment memo on Quip Network. Read Part I, our research on quantum crypto 👉 here.

-

Quantum is the new meta—but building a quantum L1 is as ludicrous as asking everyone to permanently move & live in a nuclear bunker.

So, what's the play?

This article covers both our thesis on quantum crypto and our conviction that Quip is the most realistic, high-upside solution on the market to onramp the onchain economy into the post-quantum era.

Table of Content

Part I (read 👉 here):

No, It’s Not Too Early

What Does the Post-Quantum Era Even Mean?

Crypto x Quantum: The Defensive vs. Offensive Opportunities

Part II (this article):

Why the Quantum Thesis Is So Hard

What Does “Good” Look Like?

Quip—and Why It’s the Right Solution

4. Why the Quantum Thesis is So Hard

Before diving in further, I’d like to share some context on the process of sourcing Quip. Quantum has been the sector that took us the longest—by far—from building the thesis to finding the right team and approach to invest.

As many of Portal’s friends and family are aware, we’ve been looking to place a bet in the Quantum thesis since June 2024. We canvassed the internet for the major conferences (for those interested, this website is the best aggregator I found) and flew across continents for a couple of them.

Sourcing for quantum crypto startups are challenging because

Most quantum computing conferences have no crossover with crypto.

At the very few Quantum x Cryptography conferences—such as Oxford PQCrypto—most attendees and speakers were either pure academic researchers with no interest in startups or crypto. In fact, there’s still a stigma in the cryptographer community that views crypto as scammy.

Among the even fewer cryptographers with any interest in crypto, their ideas have largely been overly technical “features” rather than actual “products.”

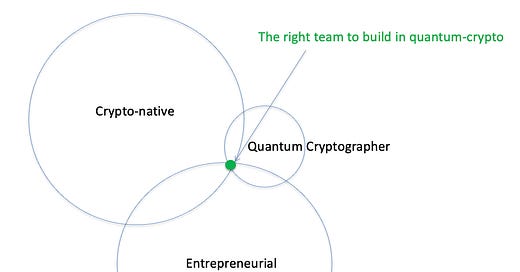

A quantum crypto startup is not something you can whip up overnight: the team needs to be at the precise nexus point of

(1) being crypto-native,

(2) an academic with deep knowledge in quantum cryptography, and

(3) entrepreneurial.

On top of the already limited talent pool, we struggled to build conviction in the approach taken by the 6–7 other quantum-crypto companies before Quip. Most aimed to build a post-quantum L1 and expected users to abandon their favorite chains for a brand new one—an idea that, to me, is as ludicrous as being asked to permanently live in a nuclear bunker.

5. What Does a “Good” Solution Look Like?

To know the solution, we should first understand the problem statement. What stands between the status quo and the adoption of PQ solution is

The accountability problem

Wallet providers and chains/protocols could technically blame each other if a quantum attack compromised user funds, since both are exposed to the attack surface. Everyone wants a scapegoat to say, “It’s not my problem.”

The incentive problem

Why Solana (or any L1) won’t do this themselves? Miners and validators have no reason to bear the added cost of storage or compute required for post-quantum algorithms. Meanwhile, 90% of users aren’t attractive targets for quantum attackers. But the remaining 10% hold 70% of the assets. Protocols have no incentive to impose the costs of securing large holders onto small ones. Post-quantum protection has to be modular and economically sound.

The inertia problem

Vitalik’s blog post discusses a hard fork as a last resort and cautions against diverting attention from other core research areas. We’ve all seen how long it’s been taking to push through an EIP. People tend to be reactive. But when you have to react, it’s too late.

The neutrality problem

Even if the protocols do implement themselves, there’s little incentive for them to ensure interoperability with other networks post-quantum standards.

The ideal solution to onramp web3 to the post-quantum world should exhibit below qualities:

Credibly neutral & interoperable: Able to integrate with any protocol, chain, or wallet.

Post-quantum accountable: Protocols and wallets should be able to outsource their post-quantum security upgrades to this third party—without validators bearing the cost or blame.

Seamless: Minimal impact on user experience; the solution should integrate natively with protocols without requiring asset bridging or migration.

Sufficiently decentralized: A network with a robust security budget and decentralized infrastructure.

Beyond Web3: To realize the offensive vision, partnerships with quantum computing providers will be a major advantage.

6. This is QUIP.

Quip Network offers—by far—the solution with the most realistic path to adoption for all stakeholders—retail users, institutions, protocols, and wallet providers alike.

At its core is the invention of QUIP (Quantum Unit Interlock Pathway), which wraps future transfers with a PQ public key for secure signatures. It can be natively integrated into any protocol or wallet to upgrade customers to post-quantum security without affecting user experience (no need to bridge/migrate onchain assets or change private/public keys) or diluting TVL from protocols.

Over time—the offensive opportunity—is for QUIP to evolve into a quantum DePIN network that offers a quantum "app store" for common off-the-shelf applications across quantum computer providers for use cases such as

shortest vector search, which covers fields as diverse as logistics, financial arbitrage

AI learning, hash acceleration, which can be used for more efficient Bitcoin mining and data indexing

authentic randomness, which is used in Monte Carlo simulations of all types.

More importantly, we couldn’t be more excited about the team: Colton—a cryptographer and ex-YC founder with CMO, CEO, and COO experience at companies with 9–10 range outcome; Dr. Carback—a veteran cryptographer and serial entrepreneur with deep expertise in privacy and quantum-resilient systems; and their advisor, Dr. David Chaum—widely regarded as the “godfather of cryptocurrency.”

We’re often asked: what are the earliest signs of winners after an investment? Without question, it comes down to speed of execution and the velocity of iteration.Within just a few months, Quip is now:

Live on 10+ top chains non-natively (with native integrations in progress)

In talks with several leading L1s offering grants for native integration

Testnet Alpha live: vault.quip.network

2,000+ users on the waitlist with 8 figures in TVL commitments

Running POCs with major custody providers with 11 figures of crypto AUM

In active conversations with some of the largest quantum computing companies in Web2