[Part I] Finding the Right Quantum Crypto Play is Harder Than You Think

Our quantum thesis & how we found Quip Network

Quantum is the new meta—but building a quantum L1 is as ludicrous as asking everyone to permanently move & live in a nuclear bunker.

So, what's the play?

At Portal, a key criterion for underwriting a new company is simple: Will this asset still be valuable in 10 years? Today, we’ll use our investment in Quip Network to illustrate how we source opportunities, build conviction, and invest.

This article covers both our thesis on quantum crypto and our conviction that Quip is the most realistic, high-upside solution on the market to onramp the onchain economy into the post-quantum era.

Due to length limit, this article will be divided into two parts:

Part I (this article)

No, It’s Not Too Early

What Does the Post-Quantum Era Even Mean?

Crypto x Quantum: The Defensive vs. Offensive Opportunities

Part II (link 👉 here)

Why the Quantum Thesis Is So Hard

What Does “Good” Look Like?

Quip—and Why It’s the Right Solution

1. No, Now is Not Too Early

There has been no shortage of quantum headlines and discussion of its risks to Bitcoin lately. This attention is justified because it’s a simple math problem: there are about 3.5 million lost BTC, including Satoshi’s ~1.1 million. That’s ~$300 billion of economic incentives for accelerating quantum computer research.

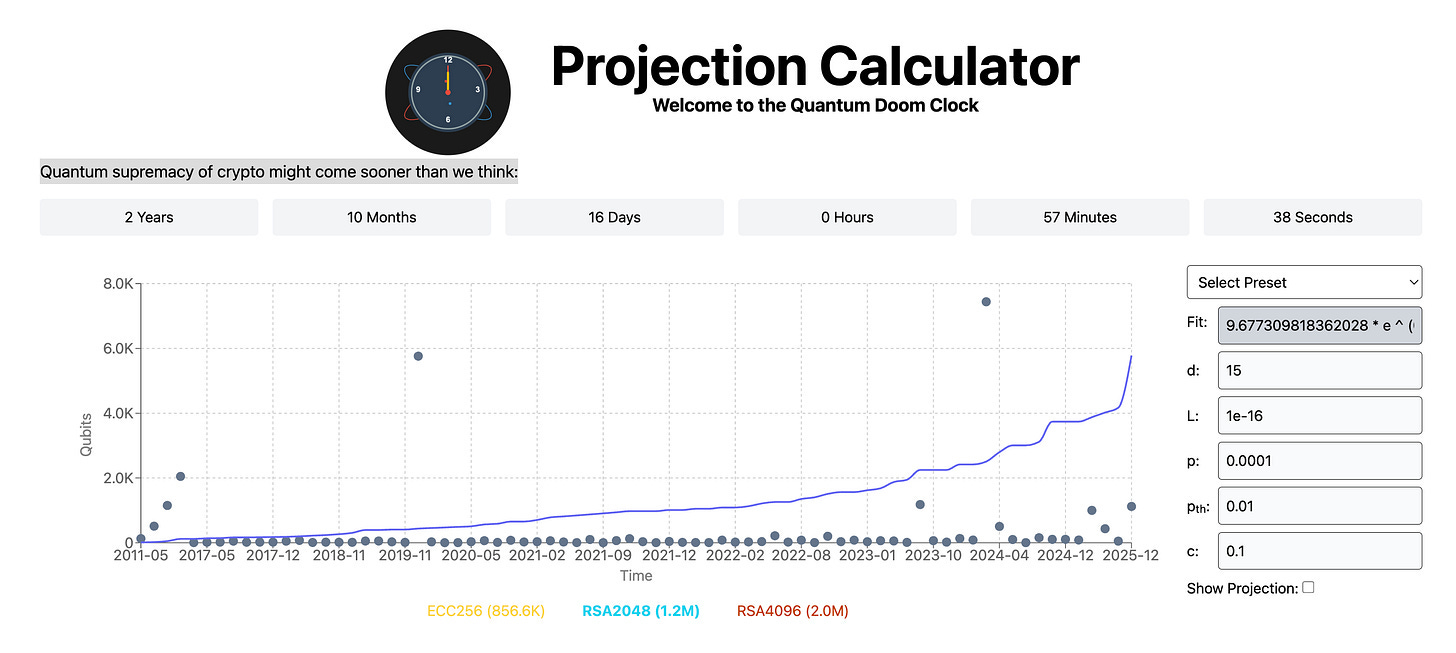

In the “Quantum Doom Clock” below, Quip places the timeline for the first commercially viable quantum crypto attack between 2027 and 2028 by plotting qubit progression since 2017.

Zooming out from crypto, IBM’s CEO predicts a “remarkable breakthrough” in quantum within 3–5 years. ChatGPT estimates the quantum threat to banking systems could materialize between 2027 and 2032 and multiple sources urge financial institutions to migrate to post-quantum cryptography by 2030.

The progress is accelerating, as evidenced by the increasing density of quantum computing headline in 2025 alone:

Microsoft’s Majorana 1 – Introduced a chip using topological qubits for improved error resistance and scalability.

IBM’s 4,158-Qubit System – Linked three 1,386-qubit chips, achieving a new qubit count milestone.

Amazon’s Ocelot Chip – Developed cat qubits, reducing quantum computing errors by up to 90%.

D-Wave’s Quantum Advantage – Solved a materials problem in 20 minutes, which would take classical supercomputers nearly a million years.

Caltech’s Quantum Network – Built a working multi-qubit quantum internet prototype, advancing secure quantum communication.

Google’s Willow Chip – Unveiled a 105-qubit chip that reduces errors exponentially, completing tasks a supercomputer would need 10 septillion years for.

Oxford’s Distributed Quantum Computing – Linked two separate processors into one system, enabling distributed quantum computation.

With the timeline set between 2027 and 2030, some may think the threat is still 2–5 years away. But here’s the punchline: you don’t build the floodgate after the storm. Both on-chain and off-chain financial rails need to be quantum-ready well before the first commercially viable quantum attack.

Time left to get ready = time till quantum attack - time to implement changes. Even if there’s only a 5% chance that a powerful quantum computer exists today that could nullify your investment, the financial risk justifies proactive protection now.

2. What Does the Post-Quantum Era Even Mean

Quantum computing has fascinated me since 2021. Back then, I wrote a primer—What’s the Big Deal about Quantum—to explore its potential, use cases, and venture landscape.

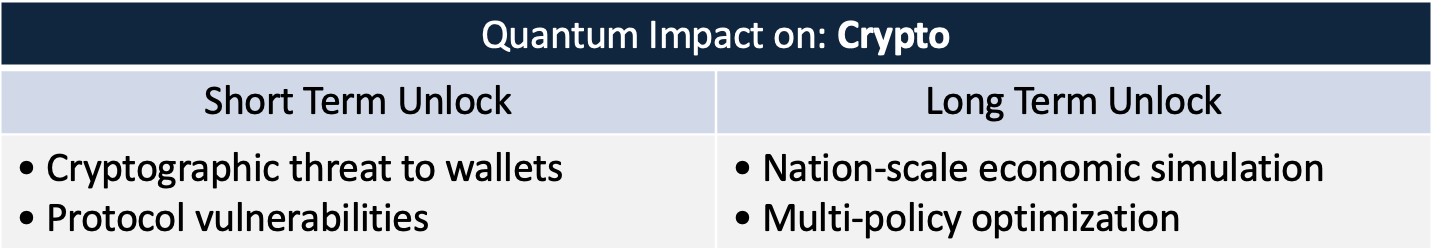

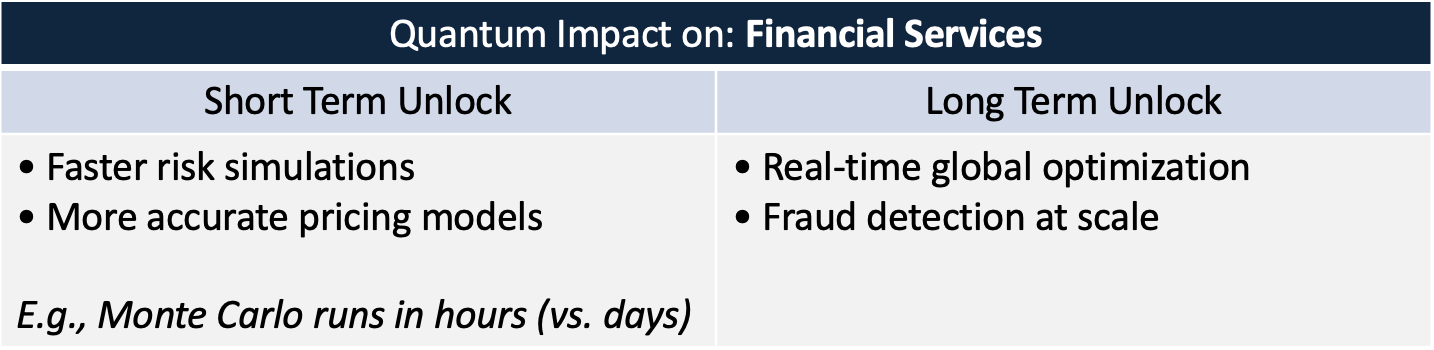

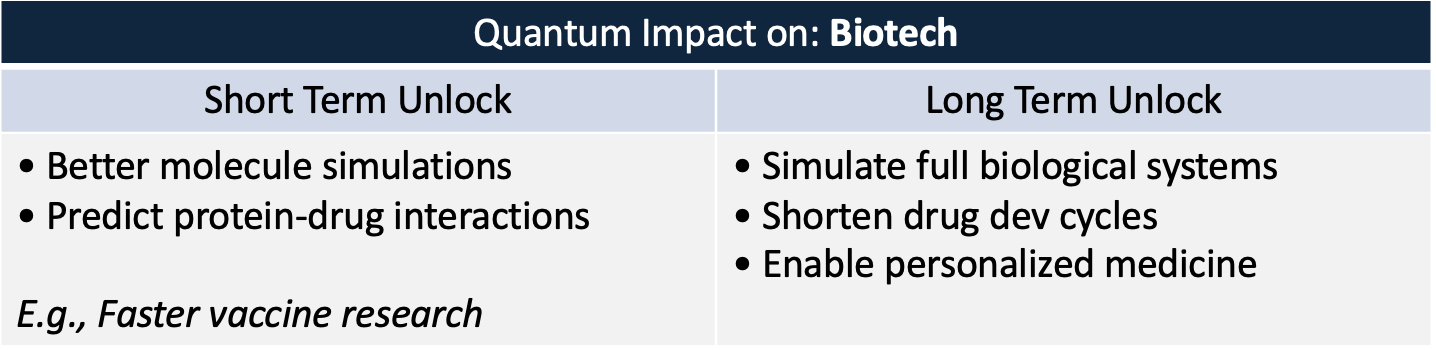

Fast forward to today, the field has made sizable leaps. Here’s my refreshed sequel—Six Industries Poised to Be Transformed by Quantum Computing with concrete examples to help conceptualize just how quantum will drive a paradigm shift across critical industries.

TLDRed below.

3. Crypto x Quantum: The Defensive vs. Offensive Opportunities

Out of the above sectors within the impact radius of quantum computers, some are defensive, others offensive. Let’s define them.

Defensive Opportunity: Adoption is driven by loss aversion—the fear that quantum computing will threaten the safety of on-chain/crypto or off-chain/financial assets held in banks.

Examples from the aforementioned sectors include Crypto and Financial Services/Banking (partially).

Offensive Opportunity: Adoption is driven by the potential of quantum computing to increase top-line revenue, expand offerings, and enable new innovations.

Examples include Financial Services, Economic Planning, Logistics, and Materials Science.

Does this mean the only overlap between Crypto and Quantum is just security?

Think bigger. Yes, for as long as decentralized finance remains the dominant use case in crypto, post-quantum security will be table stakes—a non-negotiable for any protocol. This means the post-quantum security space, in and of itself, will cover the entire $2.7 trillion TAM in crypto.

But we don’t stop there. A core value proposition of crypto is its ability to bootstrap decentralized networks of shared resources—think how DePIN increased accessibility to GPUs for companies unable to compete with Big Tech on Nvidia chips.

Such centralization will only worsen with quantum computers due to their scarcity and prohibitive costs (IBM Quantum System One costs about $15M today). While prices will decline over time, it's safe to say that most companies in the world won’t have access to a quantum computer in the near term, and personal devices with their own quantum processors are even farther away. That said, most companies also don’t need to own a quantum computer, as many of their simulations/jobs are “run once and done.”

Now comes our “offensive” Crypto x Quantum thesis: imagine a Quantum DePIN network that aggregates spare quantum computing capacity from providers like IBM, Amazon, Microsoft, IonQ, and Rigetti. While these companies already offer pay-per-use cloud access, a decentralized quantum network could unlock much more:

A token-incentivized Zapier or Hugging Face for quantum—crowd-sourcing contribution to modular tools and workflows for building and executing quantum tasks

A service network that provides better, faster services above and beyond what unaugmented classical computer services can provide

More efficient task sharing between providers that usually rent by the hour or by the day to firms in close physical proximity

This isn’t just about access—it’s about coordination, performance, and composability at a global scale.

To sum up, the opportunity set at the intersection of crypto and the quantum era is twofold:

A defensive opportunity with a $2.7 trillion TAM to secure on-chain assets from quantum attacks

An offensive opportunity to create a decentralized network to enable the masses to harness the “productive” and “top-line growth” power of quantum computing

Quip Network tackles the entire opportunity set—starting with the defensive, then moving into the offensive. It onramps the on-chain economy into the post-quantum era, first by delivering the most native and frictionless post-quantum protection to protocols, custody providers, and wallets; and later evolves into a decentralized quantum computing network—Quantum DePIN, if you will.

To be continued 👉 here

Shoutout to Colton Dillion and Dr. Richard Carback for your input & review.