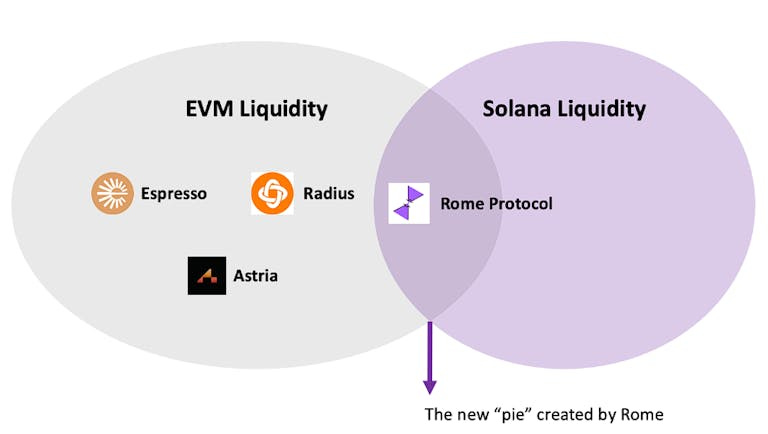

At Portal, one of our guiding principles is to back protocol businesses that “grow the pie” vs. “slice the pie.” This is what guides all of our research, including our deep dive into MEV business models or our analysis of the new use cases + value pools unlocked by FHE.

We’ve been monitoring the rise of shared sequencers (SS) since our MEV work last year. Initially, we were skeptical - SS seemed to be a ‘nice to have’ vs. ‘need to have’ layer in the modular stack, falling in the bucket of “slicing” the pie as it chips away from the existing profit pool (gas fee).

Rome changed our mind.

Today, we’re thrilled to announce that Portal led the pre-seed in Rome Protocol, a SS leveraging Solana to create a new design space and a unique product.

Setting the Stage: What is a Shared Sequencer?

A shared sequencer decentralizes block production at the sequencing layer. Customers of a shared sequencer network are rollups, such as OP Stack, ZK Stack, Arbitrum, Eclipse, Scroll, etc. Most rollups today are built on Ethereum and/or use Celestia to create a more modular stack.

Why is a SS needed?

The traditional argument in favor of a shared sequencer is based on the need to decentralize transaction sequencing and enable cross rollup atomic composition. Currently, all rollups utilize a centralized sequencer, which has the following drawbacks:

Limited visibility into transaction ordering: It is unclear how transactions submitted to the rollups are being sequenced and whether the centralized sequencers are extracting MEV.

Excessive wait time for inclusion: Each rollup has to wait for other rollups to have their transactions included on the base layer. This can lead to bid expiration, requiring a decision on whether to submit a new bid.

High cost of generating proofs: Generating proofs incurs significant costs for rollups, which is why they have remained centralized. Shared sequencers can offer a solution by allowing rollups to outsource the cost of proof generation and share costs with other rollups, achieving economies of scale.

Benefits for rollups to use a sequencer vs. sequencing tx by themselves include:

Pre-confirmation: give rollups pre-confirmation of transaction inclusion on the DA of their choice.

Performance/speed: for users such as hedge fund traders, confirmation time is of the essence. The ability to confirm inclusion in a speedy manner is key to customer acquisition for rollups.

Interoperability with other rollups: enable cross-rollup use cases via SS, which batches transactions from different rollups and executes so that end users of rollups are not bothered by “bridging” across rollups.

Intents: from the blockbuilders’ perspective, shared sequencers can give a binary pre-confirmation of whether a block they submit with some intent will succeed or not (from the probabilistic to deterministic). This way they do not have to juggle 10 different rollups to figure out the probability of inclusion.

Potential reasons that rollups would not want to use a SS

Trust Assumptions: They do not want to introduce additional trust assumptions since SS usually have to bootstrap billions of dollars of economic stake to secure the network: a chain is only as strong as its weakest link.

Value Leakage: Centralized sequencers currently collect sequencer fees and can extract MEV (although this is not something they’re supposed to do).

While we see the importance of the above, we’ve been hesitant to believe these value propositions alone are strong enough to drive significant value creation + grow the pie. At the end of the day, most SS today are still slicing the same pie within the rollup stacks or EVM liquidity. Neel Somani’s piece “Rollups-as-a-Service Are Going To Zero” is a good read on the topic of value capture here.

Rome: Not Your ‘Everyday’ Shared Sequencer

Competition is for losers. We seek out founders who create whitespace where there’s no competition. The Rome team shared this vision. While major players in SS today “slice” the pie within the Ethereum / EVM ecosystem, what excites us the most about Rome is its unique positioning to grow a significant new “pie” of liquidity between Solana and Ethereum, two of the largest market-cap ecosystems.

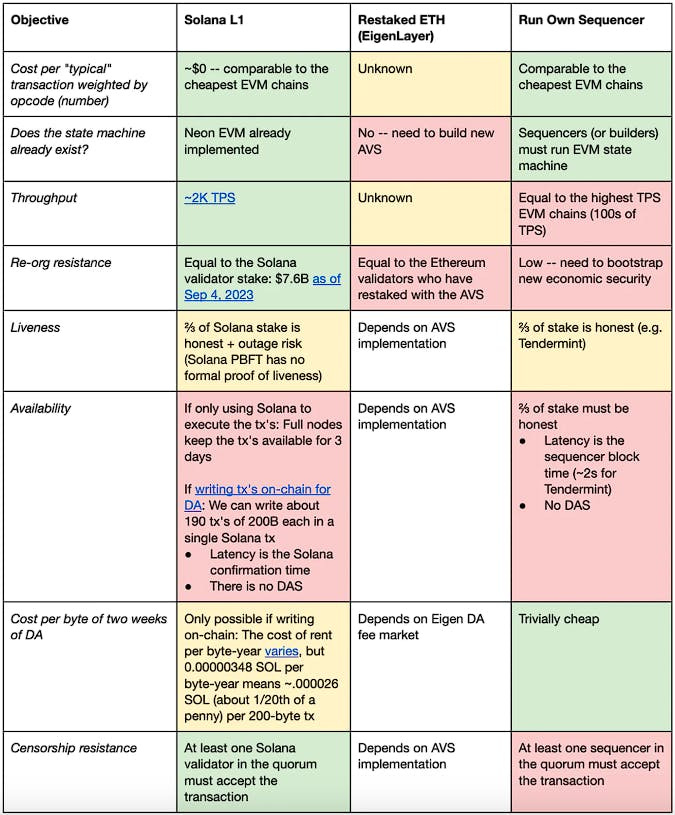

Rome is a shared sequencer that directly uses Solana for its performance and security. The Rome SS not only exhibits all of the benefits of other traditional/existing SS in EVM, it delivers additional value-add to its users via the following.

Unlock interoperability between Solana & Ethereum, entirely natively on-chain via SS vs. off-chain bridging.

The most secure SS from day one: by directly using Solana as a shared sequencer, Rome inherits the 5th largest security budget in crypto directly from Solana(~$50B at the time of writing) and is the most secure SS network by far.

Cost Reduction: Solana’s local fee markets and parallelized architecture keeps costs low. Rome benefits from this, and passes on the benefit to customers (rollups).

Speed: Solana’s throughput allows Rome to deliver a performant SS. Rollups need not worry that outsourcing their block production encumbers the user experience.

Source: Rome Protocol: The Shared Sequencer using Solana

The result: a network that natively bridges Solana <> Ethereum liquidity while delivering a cheaper, faster, and more secure approach to block building.

By ordering the sequence of transactions from both EVM rollups and Solana via atomic conditional transaction execution, Rome is uniquely positioned to unlock:

Non-custodial & trustless bridging between Ethereum and Solana without needing off-chain bridges

Cross-domain arbitrage between EVM and Solana for institutional and sophisticated traders

Enable more products / services to be ‘imported’ / ‘exported’ between the Ethereum <> Solana economies

Cross chain liquidity access allowing users to access liquidity available both the chains, atomically

Dual chain (multichain) games/dapps. Allows builders to take advantage of each chain. Speed and throughput on Solana and settlement and assets on Ethereum